As compared to the previous month, consumer confidence slipped in March due to rising gas prices. According to the forecasters, the consumer confidence index will slip to 70.0 in March, from 70.8 in February. On Monday, the nationwide average for a gallon of gas reached $3.90. Economists are worried as they think rising oil prices may force consumers to pull back their spending. As the economic outlook was improving, February’s reading reached 72. It might reach 90 in March indicating a healthy economy. In February 2009, the consumer confidence hit all-time low at 25.3. Since then, it has made a fitful recovery. Improvement in the job market is the key factor behind boosting the consumer confidence. The unemployment rate has slipped to 8.3 percent. You can read more on Financial and Business Updates from our Experts:- Stock Market News

Original Source: Consumer Confidence

International Bank of Chicago has completed the acquisition of certain assets and liabilities and the banking operations of Premier Bank. The deal was closed in a FDIC-assisted transaction. Premier Bank, which presently operates two locations in Illinois, had nearly $269 million in total assets and $199 million in total deposits as of December 31. This is the second deal for the buyer, which previously bought the Des Plaines-based All American Bank in October 2011. On the transaction, John F Purtill from Meltzer, Purtill & Stelle Inc was the buyer's legal advisor, while Eugene B Katz from Hovde Financial Inc was the financial advisor. You can read more on Financial and Business Updates from our Experts:- Mergers and AcquisitionsOriginal Source: Premier Bank

Early this Friday, gold futures bounced due to weak US dollar. Moreover, gold for April delivery rose $6.50 to $1,649 an ounce on the Comex division of the New York Mercantile Exchange. Moreover, May Silver jumped 29.5 cents to reach $31.64 an ounce. The euro also gained from $1.3197 of late Thursday to $1.3231. A soft dollar can support gold in two ways by making all dollar-denominated commodities cheaper in other currencies and encouraging gold purchases as currency hedge against greenback softness. On Thursday, gold plunged along with several kind of commodities following weak manufacturing surveys in China and the euro zone risk concerns. You can read more on Financial and Business Updates from our Experts: - Latest Stock News

Original Source : Comex Gold

NEW YORK, March 1 ( FinanceEnquiry.com) - Sunpeaks Ventures has announced the completion of the acquisition of the value-added marketer of scarcely found specialized drugs, Healthcare Distribution Specialists LLC (HDS). Besides the drug marketing attribute, HDS also owns and markets Clotamin, a specialized over-the-counter multivitamin designed exclusively for patients and Warfarin, a popular blood thinner. Sunpeaks is very excited by this acquisition and marks its advent in the hard-to-find and specialty drug distribution sector. It expects to gain considerable market by growing awareness of Clotamin and expanding its role as procurement expediter and special purchasing agent. Apart from the acquisition of HDS, Sunpeaks also announced its association with Anslow & Jaclin, amongst the top ten law firms according to "The PIPEs Report", as its lead legal counsel to advise and counsel on new and sophisticated corporate and securities transactions, self-filings, reverse mergers, PIPEs, corporate finance and mergers and acquisitions news .

New York, March 1 ( FinanceEnquiry.com) - Gas price has risen 45 cents since January 1 and is at an all-time high for this time of the year, an average of $3.73 per gallon. The question that is tormenting everyone is whether the surging gas price will destabilize the economy. However, economists argue that the situation this year is much better than early last year when a similar jump in prices stifled the economic growth and household budgets. As such, they say that the situation, so far, does not warrant any fears for economic derailment. They say that the economy is improving and as such even with the rise in gas price, other spending will not be restricted. However, if the gas price goes beyond its record of $4.11 a gallon, the situation would be worrisome. Economists are of the opinion that with the rise in price of gas witnessed so far, the economy can easily withstand the impact. The reasons being put forward by them include improving job situation, lowering of unemployment claims, an improving economy as the Dow has crossed 13,000 and the housing market is steadier than before, and consumer confidence reaching the highest level in a year. Economists believe that if the gas price reaches $4 a gallon, the consumers will feel the pinch, though they will still keep spending.

Facebook Inc. is expected to file papers for its initial public offering as early as the coming week. Morgan Stanley (NYSE: MS), which could be leading the deal, expects that the social networking giant could be worth between $75 billion and $100 billion. The issue is likely to yield as much as $10 billion.

The website’s IPO is being seen as a manifestation of the latest boom in investment in Web businesses. Facebook has attracted more than 800 million members in less than eight years of its existence. It has completely transformed the concept of global communications.

According to reliable indications, Facebook is likely to choose Morgan Stanley for leading the deal, beating other Wall Street banks that are struggling to get a foothold in the deal amid a global slump in trading to possibly earn tens of millions of dollars in banker fees. Goldman Sachs (NYSE: GS) was leading the race to head the deal till about a year back, however Morgan Stanley seems to have overtaken it. Goldman Sachs is also likely to play a significant part.

The filing for the IPO with the Securities and Exchange Commission could take place on Wednesday, according to reliable sources but some executives of the company are in favor of filing a few weeks later.

Read More: http://www.financeenquiry.com/ipo-filing-by-facebook-almost-imminent

Photographic equipment maker, Eastman Kodak Co (NYSE: EK), is preparing to seek bankruptcy protection in the coming weeks, as per a report by RTT News. It is still in the process of making last-minute efforts to avoid Chapter 11 by trying to sell off some of its patent portfolios. The company is also negotiating with banks for $1 billion in financing in order to survive the process of bankruptcy filing. The banks include JPMorgan Chase & Co (JPM), Citigroup (C) and Wells Fargo & Co. The 131-year-old company could be on the verge of filing, either during this month or in early February. Moreover, during bankruptcy protection, it will continue to pay its bills and function normally. Its main objective at that time would be to sell some of its 1,100 patents through a court-supervised auction. Kodak was a pioneer in photography, dominating the industry and producing thousands of breakthroughs in imaging and other technologies. It also invented the digital camera in 1975, though it failed to capitalize on its invention. Kodak also dabbled with chemicals, medical-testing devices and bathroom cleaners, while it was looking for suitable alternatives to its core business. It has also focused on consumer and commercial printers in the recent past.

Google (NASDAQ: GOOG) announced that it is investing $94 million in four photovoltaic panel farms in the Sacramento area. The farms belong to tech-giant Sharp and were built by San Francisco-based Recurrent Energy. Google’s investment will be in addition to the investment from Kohlberg Kravis Roberts & Co. and will go a long way in the completion of the project.

Google has been building up its portfolio of clean energy investments and its latest investment of $94 million in the Sacramento area will push its total investments to more than $915 million. It is not clear as to how much Kohlberg Kravis Roberts would be investing in the project.

Google said that although it has already been providing funds for installing solar PV panels on the rooftops of more than 10,000 homeowners, the present investment is their first attempt to invest in large scale solar PV power plants that would be generating energy for the grid and not for individuals. About 88 megawatts of power would be produced by this project, which would be able to cater to the electricity requirements of more than 13,000 homes.

Google’s spokesman indicated that this is the first tie-up between Google and KKR but as per indications, this partnership might not last. The Sacramento Municipal Utility District has already contracted the power that will be produced by the four solar farms for 20 years.

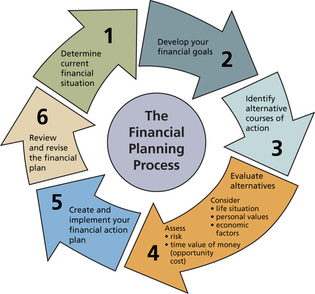

Financial planning is basically the practise of budgeting, management of your investments and long term plans for your assets. As an investor, you have to plan the proper utilization of your finances. Saving your money or capital is important while you initiate financial planning. You can have plans for daily savings, short term savings and long term savings. To ensure a better and financially secured future, financial planning is important. Considering your future financial requirements, you make plans to achieve financial goals. There are several elements associated to financial planning. Like individuals, corporations do have their financial plans to achieve business goals. Investment, asset allocation and risk management are three major basics of financial planning. Still it is worth mentioning that different individuals consider financial planning in different ways. Many of the investors want to initiate better financial planning to maximise their money. Again, there are many of us who just want to save money for our post retirement phase. Similarly, many individuals want to save money to buy property. To achieve all these goals, better money management or financial management is necessary. Today “financial management” is supported with its own set of hypothesis and definitions. Corporate financial planning There are many experienced financial planners who assist in financial management. Each company or corporation needs to manage their income and expenditure effectively. A company with a positive balance sheet attracts more investors. A profit making company always gains the confidence of investors. So, a business plan and proper budgeting are important for every company. In any business, financial planning is determined by the following: - Cash flow statement

- Balance sheet

- Income statement

When people delay in making a proper financial plan, it could become a stumbling block in the process of remaining financially afloat in the post retirement phase. There are many online articles which help can help you know more about money management. It is best to go through them to have clear insight about the steps to be taken to ensure a better future. Keeping the perfect balance between income and expenditure is most important. Instead of making huge goals it is advisable to set smaller milestones at the beginning. Effective debt management is indeed important as you are in your way to asset creation. In every financial planning, there must be room for emergency funding. It is best to note all the plans as a detailed approach is much better and effective. There are several certified professionals and in case of any doubts, it is best to seek assistance from them.

Although online game developer Zynga (NASDAQ: ZNGA) will be the first company to benefit from the recent move by San Francisco to offer tax breaks on the sale of stock options following the company’s initial public offering on Friday, the City also stands to gain from the IPO of the company. It will be like setting a record for option-related payroll tax revenue from a single company. The City made a modification in payroll tax recently as a result of which Zynga would only have to pay a maximum of $750,000 or 1.5 percent of payroll tax on the first $50 million of stock option compensation that will be given to its employees whenever they sell their shares in the company. However, there is a catch because if Zynga’s employees had ever sold more than $50 million in stock options per year before the IPO of the company, the company’s tax rate would be higher. In such a case, its maximum tax rate on stock options would be an amount equal to 1.5 percent of that amount.

|

RSS Feed

RSS Feed